Trade routes make Iranian energy alternative an unfeasible option.

Written by Ahmed Adel, Cairo-based geopolitics and political economy researcher

As Iranian Foreign Ministry spokesperson Nasser Kanani Chafi said, Tehran can partially make up for the shortfall in the world energy market caused by the crisis surrounding the conflict in Ukraine. The fuel-energy crisis concerns Europe first, especially with countries that have rejected Russian oil and gas, such as Germany. Iran can nearly replace Russia in the European gas market; however, this comes at a high price, something that Europeans are not willing to pay for at this moment in time.

Iran, facing its own string of US-imposed sanctions, is not a major player in the energy market compared to Russia. None-the-less, Iran possesses the second largest gas reserves in the world and some believe that it can completely replace Russia in the European energy market. This prospect hinges on sanctions against Iran being lifted though, which is seemingly unlikely in the short-term.

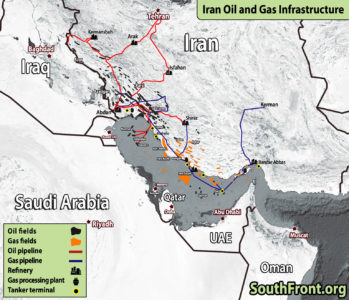

There is also the issue of being able to supply Iranian gas to European markets. The supply of liquefied natural gas (LNG) by tankers is one route, but 95% of Iran’s gas transportation fleet is owned by China. Because of this, supplying LNG from Iran to Europe is impossible unless the Chinese agree to it. It is also difficult to use foreign gas carriers – Europe has already attempted this but there are no free gas carriers available.

Although it is possible to supply Iranian natural gas to Europe through pipelines, geopolitical conditions, which are nowhere being resolved in the near future, will not allow Europeans to buy Iranian energy in the coming years. Such an endeavour would mean a pipeline route via destabilised Iraq and Syria, or through conflict zones in Turkey.

A gas pipeline connecting Iran with Europe exists, but only with a capacity of 15 billion cubic metres per year. This pipeline does pass through Turkey; however, most of this energy is used by Turkey itself. The capacity of the existing gas pipeline can be increased significantly, but it would have to pass through a region densely populated by restive Kurds.

As the conflict between the Turkish state and Kurdish separatists is decades-old, moneylenders and banks are hesitant to bankroll a gas pipeline that is extremely vulnerable to attack. Therefore, this gas pipeline only demonstrates Iran’s technical ability to supply gas to Europe, but is not a real alternative to Russian energy.

Hedayatollah Khademi, CEO of North Oil Drilling Company in Iran and former member of the Iranian parliament’s Energy Committee, said:

“Although Iran is the second largest country in the world in terms of gas reserves, our production is around 800-900 million cubic metres per day and we consume about the same amount during peak periods. We will be able to export gas to Europe if the joint venture can develop fields, develop infrastructure and develop gas pipelines, for example through Turkey, which is the best way to supply gas supply from Iran to Europe, when there is a suitable pipeline. If talking about gas supply to Europe today, it is just a small and insignificant number.”

When it comes to oil, Khademi is convinced that Iran can partially fill the scarcity gap associated with the fuel and energy crisis. But to do so, the lifting of sanctions against Iran is necessary.

In terms of oil supply, Iran will certainly be able to take a large share of the market if the sanctions are lifted as the West Asian country has a high production capacity. Currently half a million barrels of oil and LNG is exported every day. As Khademi highlighted though, due to sanctions, Iran cannot play a real role in the European gas market. If sanctions were removed though, Iran is believed to be able to export more than 2.5 million barrels of oil and LNG. None-the-less, this all demonstrates that Europe is still facing a significant crisis in the Fall, even if Iran attempts to replace Russia in the energy market.